Don’t Let the Australian Dollar’s Fall Ruin Your Investment Returns

As a floating currency, the value of the Australian dollar (AUD) is determined by supply and demand. Several factors influence this, such as interest rates, inflation, economic growth, and political stability.

How investors manage currency exposures can have a substantial impact on investment returns. Investors may choose to hedge their currency exposure, which helps protect against losses if the currency they are invested in depreciates.

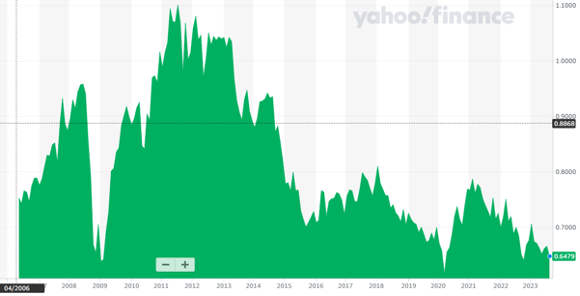

Current value of the Australian dollar

As of today, September 8, 2023, the Australian dollar is trading at around $0.64 to the US dollar. This is down from its recent peak of around $0.80 in 2021. The fall in the relative value of the AUD is due to several factors, including rising interest rates in the United States, a slowdown in economic growth in China, and concerns about the global economy.

How the Australian dollar affects investment returns

Australian investors often hold substantial international exposure as it can help to diversify portfolios and reduce risk, gain exposure to other economies and industries. However, the impact of currency fluctuations should not be underestimated when investing internationally.

For example, if an Australian investor owns US dollar-denominated shares, and the AUD depreciates against the USD, then the value of those shares will rise in AUD terms. This arises because investors can sell their US denominated shares and purchase more AUD than would be achievable if the AUD were more expensive.

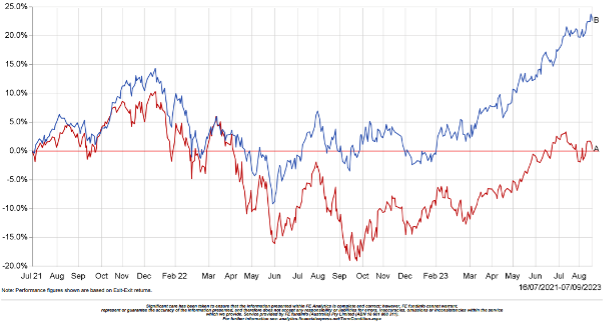

The fall in the value of the Australian dollar over the past two years has provided additional returns for Australians who have invested internationally and have not hedged their currency exposure. This is seen when comparing the performance of the currency hedged and unhedged versions of iShares S&P 500 ETF, which tracks the performance of the largest 500 listed companies in the United States:

As we can see in the above chart, investors who did not hedge their currency risk have benefited from substantially higher returns than those who did hedge their currency risk. Another way to look at this chart is that the fall in the value of AUD against the USD has been the main driver of returns rather than any increase in the value of the S&P500 index.

The opposite is true when the Australian dollar appreciates against another currency. This can have a negative impact on the investment returns of Australian investors who own assets denominated in USD. Simply, if US denominated shares are sold, less AUD can be purchased with the proceeds.

March 2020 was the last time that the AUD traded below its current level, reaching a low of $0.58 against the USD. As share markets recovered from the depths of the COVID-19 sell-off, investors benefited from the strong recovery. However, those who did not hedge their currency risk substantially underperformed investors who did hedge their currency risk:

How to manage currency risk

Hedging currency risk is a way to reduce the risk of losing money due to changes in the exchange rate. It can be done by using financial instruments such as forward contracts, currency options, and currency swaps. Alternatively, investors can leave this to the professionals by investing in currency hedged funds, such as ETFs.

The best way to manage currency risk will depend on your individual circumstances and investment goals.

We can help