It can be difficult to tell how much you really need to have a comfortable retirement. Even when you think you’ve prepared well enough, there are so many moving parts to consider and financial variables that can derail your plans.

It’s all a little overwhelming! Never fear, as we’re about to walk you through some of the key things to consider when planning out your retirement finances.

In reality, financial planning is about implementing strategies that allow you to enjoy an adequate standard of living both now, and in the future. When we properly plan ahead, we can avoid a steep decline in our lifestyle once we hit retirement by making small but manageable lifestyle adjustments along the way.

An underrated aspect of financial planning is the ability to expect the unexpected. It’s more likely than not that there will be something to throw a spanner in the works of your meticulously created plans; as we all know, life tends to just happen, and economic conditions can flip in the blink of an eye. Because of this, it’s better to hope for the best and prepare for the worst; regardless, your future self won’t be mad about having a little extra cash to splash!

When it comes to making a retirement plan, you should generally consider these four key elements: timing, lifestyle and priorities, income and living costs, as well as planning for the future. When do you want to retire? What lifestyle luxuries are non-negotiable for you? What will your income and expenses look like during retirement? What can you do now, to plan for the future and ensure that you and your loved one are financially covered?

Be specific and realistic, to ensure that your retirement plan covers your living costs and leaves enough room for spending on the things that bring you joy and happiness.

Why you shouldn’t rely solely on super fund calculators

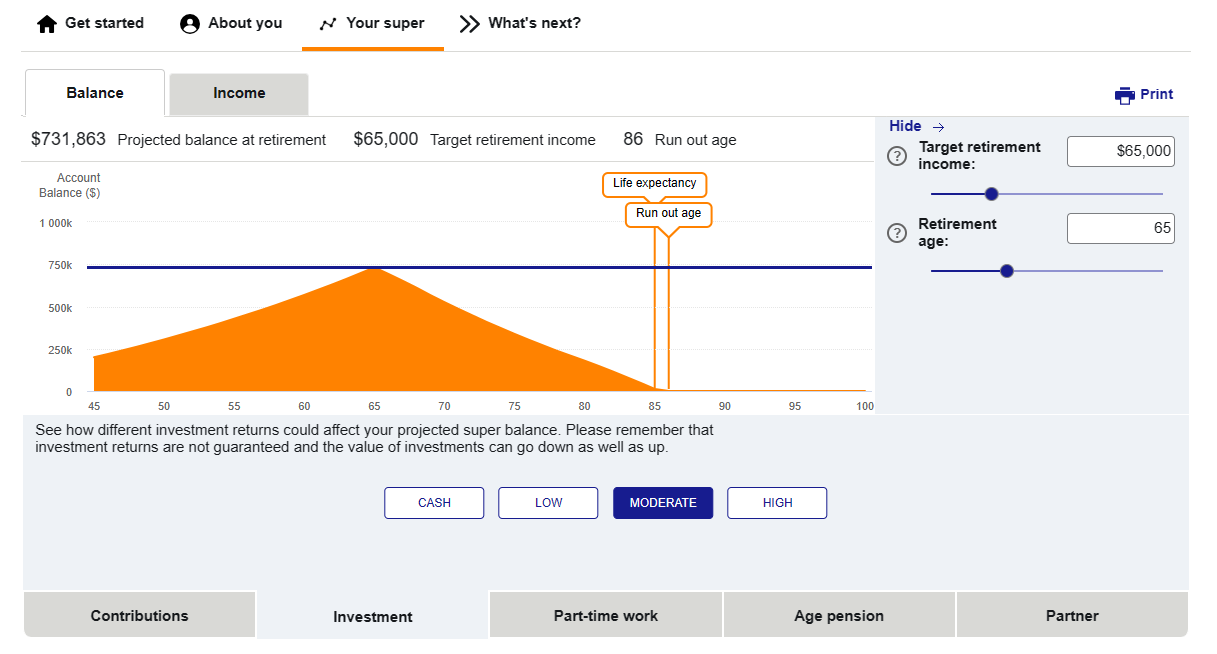

Looking at super fund calculators like this one, it’s easy to get excited as you watch annual returns stack up into a fairly hefty sum of money. However, it’s important to not rely too heavily on these calculations when planning for your retirement.

Superfund calculators are based on an average, estimated return on investment which may or may not actualise in the future. A plethora of economic factors can affect annual rates of return, meaning the returns you receive might be different from your expectations.

Superannuation can be enough to meet retirement income needs, but people tend to underestimate how much super they need, largely thanks to industry super fund retirement income calculators.

Consider this case study, where we crunch the numbers on a popular super calculator:

- AustralianSuper’s retirement calculator suggests that a super balance of $731,863 will provide $65,000 per annum of income from age 65 and run out at age 86 based on a return of 7.3% per annum.

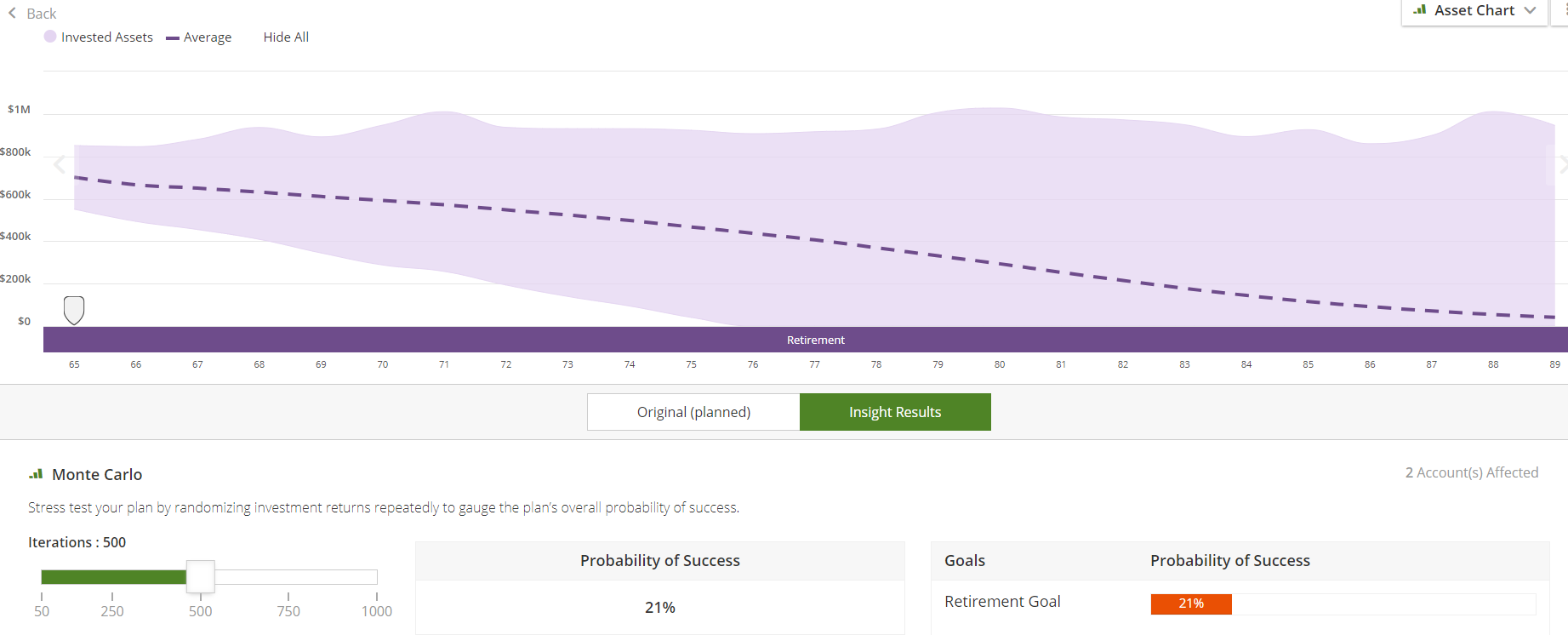

- Reliance on a rate of return of 7.3% per annum is risky. As interest rates are set to be higher for longer, the ability of investments to provide returns at this level for the next 15 years is highly questionable. Our team used a Monte Carlo simulator to assess the likelihood of a $731,000 super balance being able to provide lifetime income of $65,000 and found only a 21% chance of success after factoring in the sequencing risk of returns.

While they’re a useful resource, super fund calculators aren’t equipped to show you the full picture of your financial future in retirement. Due to the unpredictable nature of markets, we recommend being conservative with growth estimates and leaving a financial buffer in case poor economic conditions strike.

Other factors can also play a big role in your retirement savings, such as whether you’re planning to pay off your mortgage before retirement, or if you’re going to use your super to do so.

When sequencing risk affects super funds

Sequencing risk. Maybe it’s something you’ve never heard of – but it has big potential to erode your super savings.

It’s all about timing. Investment returns vary from year to year, as the investment market fluctuates. Generally, we expect these to smooth out over time, especially within a diversified super fund investment portfolio.

However, negative returns within your super portfolio can have wildly different effects on your financial outcomes depending on where you are in your savings journey. Say you’re hit with a 20% loss at the start of your career when your nest egg is relatively small. This would represent a small loss that will likely be recovered over time. However, if your portfolio experienced a 20% loss right before retirement, this would have wildly different implications for your retirement savings. Not only would it represent a much greater loss in dollar terms, being a percentage of a considerably larger batch of savings, but it also leaves your super with less time to recover before you retire. Not ideal!

Super Guide explores this idea in a succinct case study, showing that the timing of investment returns can have profound impacts on your super account balance upon retirement. And yes, you guessed it: your standard super fund calculators don’t account for these fluctuations.

While the investment market is (unfortunately) out of your control, there are a number of ways you can manage this risk. Cooee Wealth Partners typically uses the bucket strategy in managing a retirement income, which enables our clients to distinguish different “buckets” of savings for different needs and with varying purposes.

How to accurately prepare and calculate financial goals for retirement

It can be challenging to accurately prepare financial goals for retirement. There’s a seemingly endless sea of factors to consider; do you pay my mortgage off before or after retirement? What activities will you keep up with? Do you want to travel post-retirement? What unexpected expenses may you encounter?

In Cooee Wealth Partners’ experience, what clients need in retirement is generally about 25 times their annual income goal. This is based on an assumed portfolio yield of 4%, which allows for any capital growth to be retained and reinvested to allow the portfolio value to be maintained in real terms.

Interestingly, we see that clients are generally off base by 30-40% with their estimated current living expenses. It’s easy to lose track of certain expenses, which is why it can be an asset to reach out to a Wealth Partner, who has the financial planning process down to an art.

Let’s walk through Cooee Wealth Partner’s typical strategy to help people with financial goal setting.

One of our favourite exercises with clients is to work out their net after-tax income and subtract expenses that aren’t likely to persist after retirement, such as kids’ school fees and home loan repayments.

From the remaining funds, we assume that whatever isn’t used for savings or investments represents the client’s ‘lifestyle’ budget – the amount they spend on holidays, activities, meals out and anything else contributing to their lifestyle and well-being.

After we hash out how much they’re currently spending to support their lifestyle, we ask clients what they see themselves doing differently in retirement. Will they be travelling more? Participating in different activities? Desired lifestyle factors must be considered in order to put together a realistic and sustainable retirement income goal.

It’s important that your financial goals are specific, measurable and time-based. This makes it easy to carry out actionable steps to make your financial dreams a reality. It’s also important to regularly measure your progress and see whether you’re on or off track, so you can make adjustments accordingly. Furthermore, it’s imperative for your goal to have a set deadline to ensure you stay motivated and can map out the timeline of your progress easily.

All in all, planning out your retirement finances can be a little daunting, but your future self will definitely thank you for the effort. It can lead to large improvements in your quality of life during retirement and take a whole load of stress off for you and your loved ones.

With practical and realistic advice, you can get your financial planning out of the way and properly experience the retirement you want. Book a meeting with one of our Wealth Partners to find out how you can get started on your retirement planning journey.

With practical and realistic advice, you can get your financial planning out of the way and properly experience the retirement you want. Book a meeting with one of our Wealth Partners to find out how you can get started on your retirement planning journey.