It is common for our clients to ask us why we recommend they invest internationally. This is a great question, especially when we consider remote investments that don’t feature in everyday conversation. After all, why would you bring perceived uncertainty into your portfolio in a world of constant geopolitical issues and international conflict?

Yet, we think it’s best to attack this question a different way: Why would we invest only in Australia and the United States when over 80% of the world’s economic growth sits outside these two regions? Why would you invest only in Australia and the U.S. when you can buy strikingly similar companies elsewhere at less than half the price?

Investing in Australia and the United States will always be important, but we need to remember it is not the only game in town. Here is a current snapshot of where Australia and the U.S. currently fit in the world:

- Population: Australia is only 0.33% of the global population. The U.S. is 4.23% of the global population. So, over 95% of the world lives beyond these borders.

- Size of Economy: Australia is only 1.0% of global Gross Domestic Product (GDP). The U.S. is 15.4%. Combined, over 83% of the global economy is outside these borders.

- Market breadth: Australia has just over 2,000 public listed companies and the U.S. has over 9,000. Yet, there are almost 60,000 equities in the world, so approximately 80% of all public listed companies in the world exist outside these markets.

Sources: Population (Worldometer, 2023), GDP (International Monetary Fund, 2022), Market Breadth (World Federation of Exchanges, 2022 Dataset)

Getting Your Asset Allocation Right

If it wasn’t yet obvious, investing internationally can bring potential opportunities for wealth creation. It brings different risks too, but these can be managed. And with the right investment strategy it can be well worth the effort. For Cooee Wealth Partners, the key to winning in this space involves:

- Adding diversification to Australian and U.S. investments, with different risk and return drivers.

- Not overpaying for growth, by focusing on areas that trade at sizeable discounts.

- Sizing these positions appropriately, then being patient with them until the opportunity matures.

In truth, international diversification should always be part of the conversation, but it feels particularly important today. By selectively holding international companies, you have a better chance of differentiating your exposure and driving new revenue sources in the fastest-growing parts of the world.

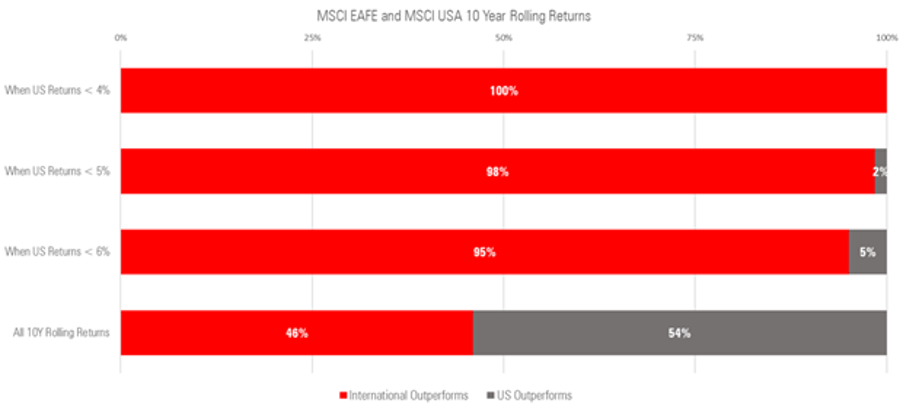

Another reason to like international stocks is that they tend to do well when major U.S. stocks perform poorly. It certainly helps to have a growth-oriented ballast in the face of inevitable setbacks. The below research from Morningstar shows that when U.S. stocks do poorly, international stocks ex-U.S. (defined as Europe, Australasia, and Far East) have historically risen to the occasion.

Source: Morningstar Direct 30 June 2023. 10 Year rolling returns calculated with data starting 1/1/1970. You cannot invest directly in an index. Past performance is no guarantee of future returns.

A Reason for Confidence

We appreciate some clients feel uneasy when investing outside their comfort zone. We believe this is in part a misunderstanding, although is usually well intended. Local equities will always feature in client portfolios and the merit for international investing should only be considered with strong risk management.

In today’s case, we’re increasingly of the view that that international exposure outside of the U.S. can provide both diversification and opportunity at the same time. Or said another way, we can potentially have our cake and eat it. International investing certainly deserves a place in most portfolios—and we feel positive about the international exposure recommended to clients through Cooee Wealth partner’s model portfolio. We will continue to monitor developments closely and update you as needed.

If you’d like to discuss this further, or any other matter, please don’t hesitate to get in touch.