It can be quite discouraging to see the cost of living continue to rise at a time when investment markets seem to be treading water, as they have been doing for a few years. Indeed, we’ve faced a challenging time for all types of investors—from conservative to growth-focused—with the market presenting a mix of ambiguity and only selected opportunities for growth.

We’ve endured a major reset in the economy, with higher interest rates causing a big change in sentiment. Even defensive-minded assets like bonds have experienced uncertainty. But it’s important to remember that it is precisely in such periods of volatility that the seeds of future growth are often sown. For example, we now have investments in your portfolio that are locking in sizeable yields, so we have a new baseline to grow from.

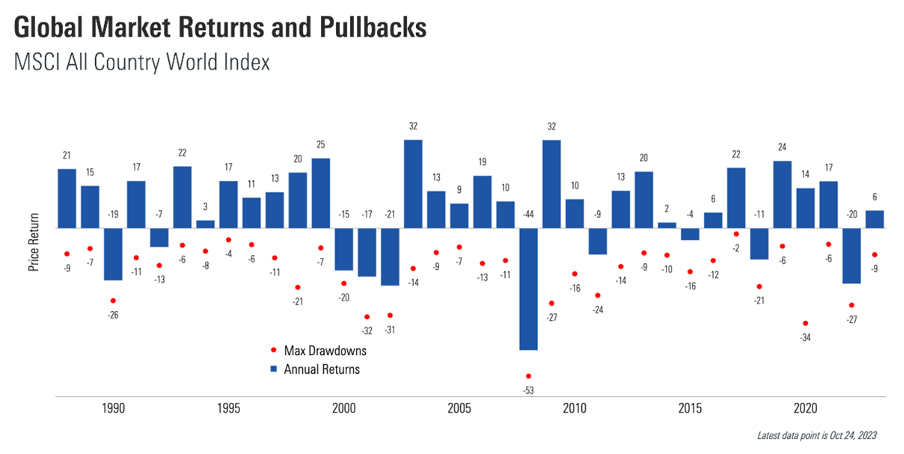

Moreover, we still have every reason to expect markets will trend positively over time, even off the back of challenging economic conditions. Below we share some evidence, where we can see that global stocks have been positive in 26 of the last 36 years, with 7% gains on average excluding dividends. However, in every single one of these years, we’ve seen a decline (the red dots) and the average decline has been right around 15%. So, it’s extremely normal for the markets to misbehave as they trend higher. The message we want to get across here is that market setbacks are the price you pay for healthy returns.

Source: Clearnomics, Morningstar Wealth, MSCI.

On a brighter note, the Investment Committee at Cooee Wealth Partners have been busy identifying some opportunities ripe for exploration. After conducting thorough research and analysis, we are becoming more optimistic after the reset, with certain asset classes and sectors that could provide attractive rewards relative to the risks involved. In some instances, where markets have sold off, we are looking to acquire these assets at attractive prices, seeking to improve long-term growth and income. This underlines the importance of not viewing the current market environment through a backward-looking lens but exploring every facet of it for potential growth.

Uncertainty is Difficult, but Patience Pays

We remain confident in your portfolio construction, and we have avoided the major dislocations to date. In some respects, your investments are holding up better than you might perceive. As one small example, those who invested heavily in long-dated bonds—which can especially appeal to some retirees—have fallen as much as 48% since inflation took off from 2020 to today1. That’s similar to what stocks experienced in the financial crisis.

Remember, investing requires consistent effort, discipline, and the ability to ride through the highs and lows. I want to assure you that despite the challenging market conditions, we believe that your current portfolio is still well-positioned to meet your financial goals. Our goal has always been to align your portfolio with your risk tolerance and long-term objectives, and we stand by that commitment. The key now is to continue making informed decisions and stay the course.

We are always available to address any questions or concerns you may have about your portfolio or any other financial matter. Your financial progress is our priority, and we are here to navigate turbulent waters alongside you. Brighter days lie ahead, even if it may require a dose of patience.

We will continue to share valuable insights that will aid you in making informed decisions, keeping your long-term financial goals in sight. If you’d like to discuss any of the above, please don’t hesitate to reach out.