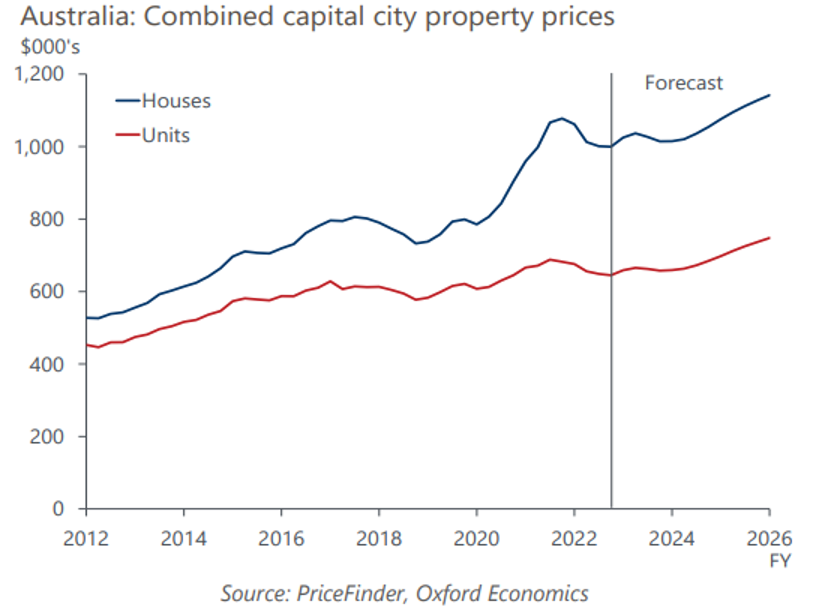

The Australian Property Market Outlook in 2023 and Beyond The Australian property market has been on a roller coaster ride in recent years, with periods of rapid growth followed by sharp declines. The current market is no different, with prices having risen for the past five months after falling for six consecutive quarters.

So, what is the outlook for the Australian property market in 2023 and beyond? There are several factors to consider, including:

-

- The rising cost of living: The cost of living in Australia is rising, which is putting pressure on household budgets. This could lead to some people delaying or reconsidering their plans to buy a property.

- Rising interest rates: The Reserve Bank of Australia (RBA) has raised interest rates to combat inflation. This makes it more expensive to borrow money, which could also weigh on the property market.

- The supply of properties for sale: The supply of properties for sale is currently low, which is supporting prices. However, this could change if more properties come onto the market.

- The demand for properties: The demand for properties is still strong, particularly from first-home buyers. However, this could weaken if the economy slows down.

Expert predictions:

- According to REA Group, national property prices are expected to increase by up to 5% in 2023, having already lifted more than 2% since the start of the year. The strongest growth is expected to be in Perth with growth of between 4 and 7 per cent.

- The Housing Industry Association (HIA) is more cautious, predicting that prices will rise by only 2% in 2023. The HIA is concerned about the impact of rising interest rates and the slowing economy on the property market.

- AMP Capital is also expecting a more subdued market, forecasting that prices will rise by just 1% in 2023. AMP Capital believes that the market is already overvalued and that the RBA will need to raise interest rates more aggressively than expected to bring inflation under control.

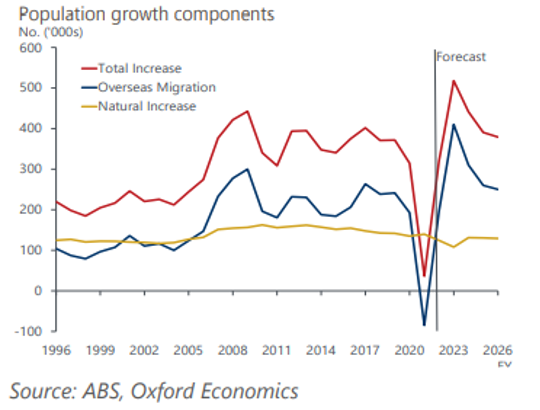

The impact of migration

The Australian government has forecast that net overseas migration will reach 400,000 in 2023, 320,000 in 2024, and 250,000 in 2025. This is a significant increase from the 200,000 level of migration that Australia has seen in recent years.

The influx of new migrants is expected to have a positive impact on Australian property demand over the next few years. The new migrants will need to find housing, which will create demand for properties in all major cities. The impact will be felt most strongly in Sydney and Melbourne, which are already facing acute housing shortages.

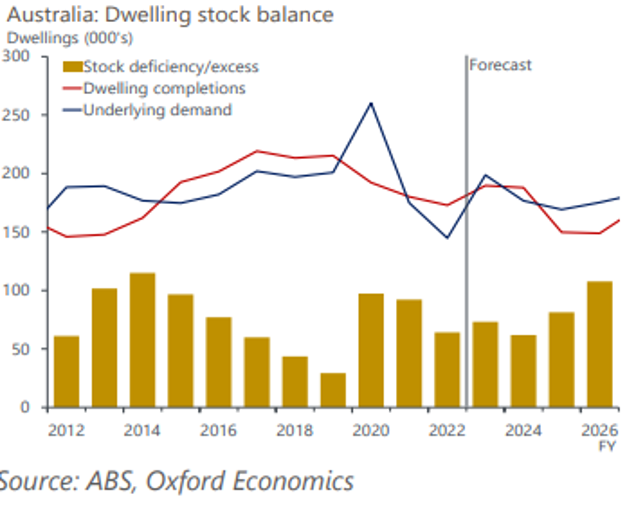

Supply Constraints

The supply of housing in Australia has not kept up with the demand, which has been a major factor in the rising property prices. According to the Australian Bureau of Statistics (ABS), the number of new housing approvals fell by 15.4% in the year to March 2023. This was the largest annual decline since 2011.

The decline in new housing approvals was driven by several factors, including the rising cost of construction, the lack of available land, and the lengthy planning approval process.

The ABS also reported that the number of vacant dwellings fell by 0.4% in the year to March 2023. The decline in the number of vacant dwellings was due to several factors, including the increasing demand for rental properties and the rising cost of buying a home.

The combination of declining new housing approvals and falling vacant dwellings has led to a tightening of the housing supply. This has put upward pressure on property prices and made it more difficult for people to find affordable housing.

The government is currently considering several proposals to increase the supply of housing, such as building more public housing, providing tax breaks for developers, and making it easier to subdivide land. These may provide opportunities for astute property investors.

Why it’s important to look beyond the national property outlook and consider the potential in different locations

The Australian property market is made up of many different locations, each with unique market dynamics. While the national outlook can provide some general guidance, it’s important to dig deeper and understand the specific factors that are driving the market in each location.

Here are some of the reasons why it’s important to look beyond the national property outlook:

- Different locations have different growth potential. Some locations are more likely to experience strong growth than others, due to factors such as economic growth, population growth, and infrastructure development.

- Different locations have different risk profiles. Some locations are more risky than others, due to factors such as economic volatility, population size and natural environment.

- Different locations offer different lifestyle options. Some locations offer better access to jobs, schools, and amenities than others.

To get a better understanding of the potential in different locations, it’s helpful to look at how they have performed in the past. This can give you some insights into the factors that have driven the market and the likely future trends.

For example, Sydney and Melbourne have historically been the strongest-performing property markets in Australia. However, they have also been the most expensive markets, and they are now facing some challenges, such as rising interest rates and limited housing supply.

Other capital cities, such as Brisbane and Adelaide, have also performed well in recent years. These markets are generally more affordable than Sydney and Melbourne, and they offer a good mix of lifestyle options.

Regional areas have also seen strong growth in recent years, particularly those that are close to major cities or have strong economic growth. However, regional markets can be more volatile than capital city markets, which provides both risk and opportunity.

Achieving Improved Returns

Savvy property investors can use a variety of strategies to improve their property returns. These strategies can include:

- Property subdivision: This involves dividing a larger property into two or more smaller properties. This can be a good way to increase the value of a property and generate more rental income.

- Property renovation: This involves making improvements to a property, such as updating the kitchen and bathroom, adding new flooring, or painting the walls. This can also increase the value of a property and make it more attractive to renters.

- Property development: This involves building new properties on land that is already owned or acquiring land and developing it. This can be a more expensive strategy, but it can also be more profitable.

- Airbnb rental: This involves renting out a property on a short-term basis, such as through the Airbnb platform. This can be a good way to generate more income from a property, but it can also be more risky, as there is no guarantee of occupancy.

- Granny flats: This involves building a self-contained unit on the same property as a main dwelling. This can be a good way to provide accommodation for aging parents or other relatives or to generate rental income. However, the additional investment to build a granny flat doesn’t always result an in increase in the value of the property.

The best strategy for any investor will depend on their circumstances and goals.

What should you do?

The Australian property market is a complex and ever-changing landscape. There are many factors to consider when making investment decisions, such as the current market conditions, the potential for future growth, and your goals and risk tolerance.

In this blog, we have discussed some of the key factors that are likely to impact the Australian property market in 2023 and beyond. We have also covered some of the strategies that savvy property investors can use to improve their returns.

If you are considering investing in property, it is important to do your research and get professional advice. Our Wealth Partners can help you understand your options and make informed decisions.

Here are some additional things to keep in mind when investing in property:

- Your investment goals: What are your goals for investing in property? Are you looking to generate passive income, build wealth, or both?

- Your risk tolerance: How much risk are you comfortable taking with your investment?

- Your budget: How much money do you have to invest?

- Your time horizon: How long do you plan to hold your investment?

It is important to consider all of these factors when making investment decisions. With careful planning and execution, you can achieve your property investment goals.