How would you rate your risk tolerance?

We find that a lot of people have a “low risk” mentality when they first start investing, but as you continue getting more experience, this might (and should) change.

Experienced investors know that low risk results in low returns, but could result in higher risk long term.

If you don’t take enough risk early on, you may not accumulate enough to fund your goals. You bring in a new type of risk, which is the risk of failing to achieve your goals and the risk of running out of money in retirement.

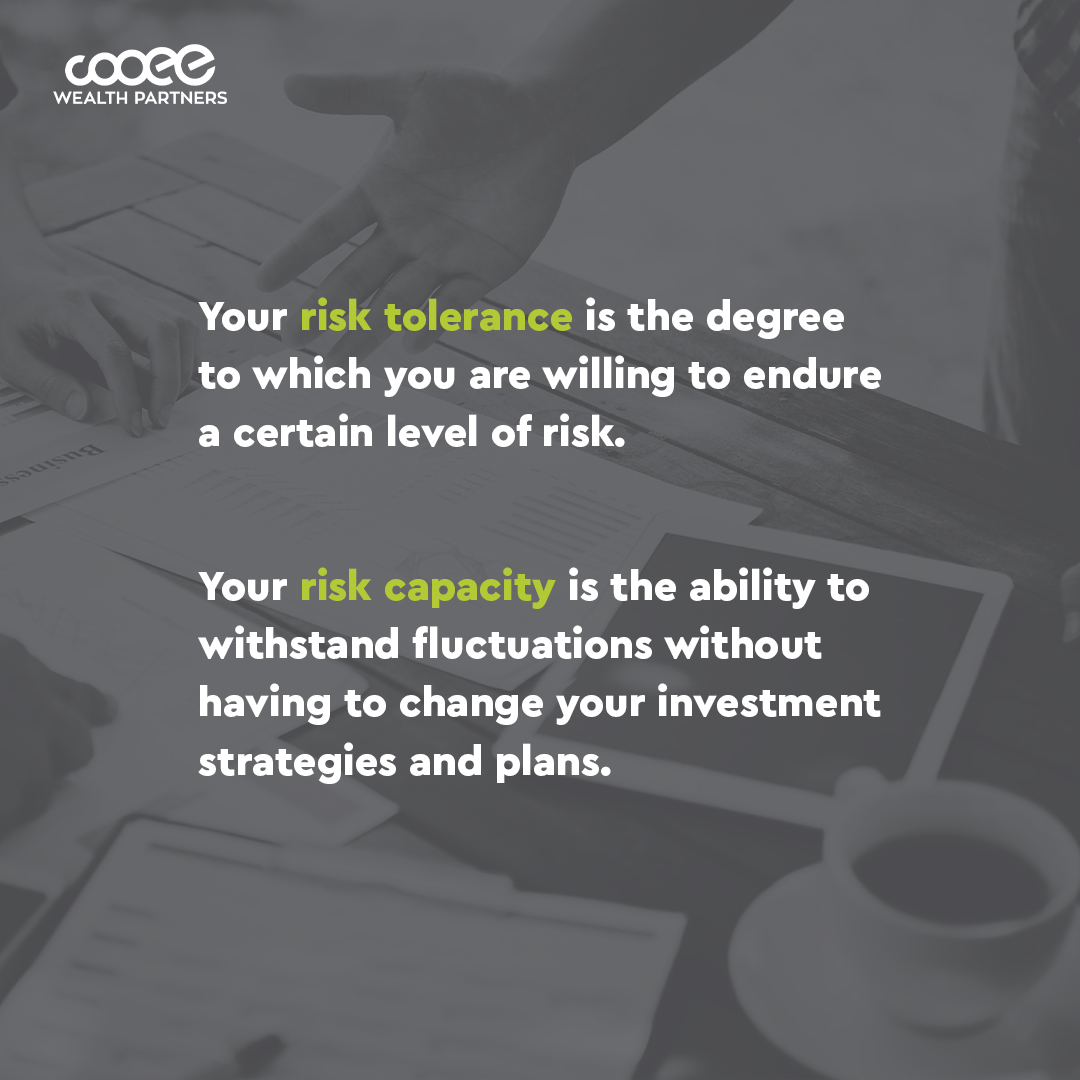

This disconnect between risk tolerance and risk capacity is a problem we find with potential clients: Most unadvised young investors are investing with more risk than they can tolerate, while advised clients tend to exhibit low-risk preferences, even though they have a higher risk capacity.

The earlier you start investing, the more risk you can take, because you have the benefit of time to overcome the ups and downs. The later you start investing, the lower your risk capacity will be, requiring smart (and often conservative) investment decisions so that you can weather those inevitable bumps on your journey.

So it’s not just your risk tolerance that you need to consider when creating an investment portfolio; you also need to consider whether it aligns with your current risk capacity, and how you can leverage both to your advantage.

Having a solid financial plan can help you establish well-defined goals and how you can achieve them with an investment strategy. Understanding your own risk tolerance and risk capacity is crucial in creating your financial plan and making effective investment decisions.

How to determine your risk tolerance

Investopedia defines risk tolerance as the degree of risk that you’re willing to endure, considering the volatility in the value of an investment. Risk tolerance is an important factor in determining the type and amount of investments that you choose.

Risks in investments include stock volatility, market swings, regulatory or interest rate changes and even economic or political events. These factors can impact your investments, so it’s important to create strategies that can risk-proof your portfolio as much as possible.

At this point, you may be tempted to start Googling questionnaires to identify your own risk tolerance. However, we don’t recommend completing a questionnaire without a trusted financial adviser to guide you through the risk profiling process.

How to determine your risk tolerance

By not taking enough risks, you might not accumulate enough wealth to meet your goals.

Higher-risk investments tend to have higher long-term returns.

For example, a 35-year-old earning $120,000 per annum, receives an 11% super guarantee and a starting super balance of $100,000. A moderate-risk investment, producing 6% per annum, is likely to result in a super balance of $721,223 at retirement.

If we increase that risk level a little bit and switch to a growth approach, earning 8% per annum, the estimated balance at retirement increases to $1,100,811.

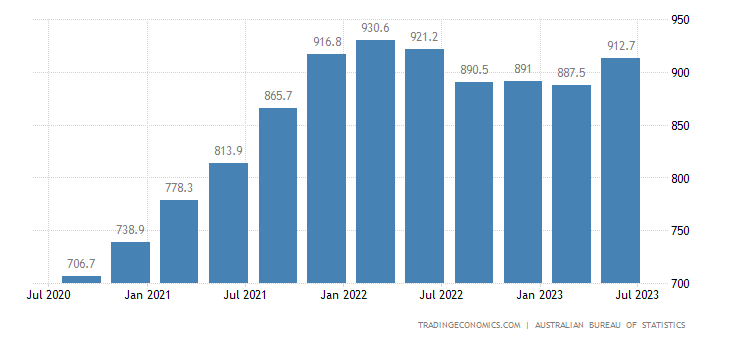

Another example is where people were scared away from buying property due to the onset of the Covid-19 pandemic. According to Trading Economics, the median house prices skyrocketed to an all-time high of 930.60 AUD thousand in the first quarter of 2022, as indicated in the graph below.

Source of image: Trading Economics

Waiting and sitting back results in substantially higher purchase prices, meaning higher mortgages, increased repayments, less free cash flow for lifestyle, debt reduction or wealth accumulation strategies. Having well-thought-out high-risk investments can prevent you from encountering these potential issues and help you in achieving your goals.

How a financial adviser considers your risk tolerance in developing your financial strategy

The first step your financial adviser should take in assessing your risk tolerance is completing a risk profiling exercise.

Wealth Partners are committed to helping clients achieve their goals, as they have the client’s best interests in mind. This is what you need to strive for in your partnership with a financial adviser, it needs to be clear that they are focused on helping you achieve the best outcome.

At Cooee Wealth Partners, we use the risk profiling exercise as a starting point before looking at “trade-offs”. If you aren’t on track to achieve your goals, would you prefer to take more risks or change your goals?

For example, you might want to shift to a high-risk investment by putting down money in a global stock fund, which can be highly diversified and growth-focused. This is in the hopes of generating enough returns to help you buy a property. However, you’re uncertain about whether you can withstand losses in the interim, regardless of whether the stock will generate positive returns in the long term. If this is the case, it might be better to shift to a more balanced fund or even develop a different strategy altogether. It might also mean having to revise your financial and investment goals, ensuring that it’s more aligned with your capabilities (and limitations) as an investor.

This is related to the concept of risk-return trade-off, which is one of the fundamental aspects that investors consider while making each investment choice and evaluating their investments. According to the theory of risk-return trade-off, as the level of risk increases, so does the potential return.

There are several criteria to consider so you can determine the optimal risk-return trade-off, such as an investor’s risk tolerance, the number of years until the person retires and the investor’s ability to replenish lost assets. And of course, consulting with your financial adviser and getting their insight regarding your risk profile.

When combined with financial planning, the risk-return trade-off can help you establish a good balance between risk and return on your investments. It’s also beneficial for optimising your portfolio by considering the level of return or maximising profits in exchange for a certain level of risk.

Don’t let your risk tolerance hold you back from achieving your financial goals. Partner with a financial adviser who can help you build an effective financial strategy in realising your dreams.

If you’re ready to take (acceptable) risks and grow your wealth, book a call with us.